Part One: Insights on BEV ownership from Mullen Automotive's comprehensive study on the U.S. electric vehicle market.

According to Argonne National Laboratory, despite the global pandemic and supply chain issues, as of May 2022, there were a total of 2.69 million electric vehicles (EVs) on U.S. roads. The increasing share of electric vehicles is primarily attributed to a growing consumer acceptance of EVs, which coincides with elevated gas prices and recent OEM announcements of substantial investments in electrification.

Based on data from IHS Markit, by 2035, about 45% of new car sales could be electric; by 2050, about half of the cars on the road would be electric. President Joe Biden has set a goal of having half of new car sales be electric, fuel cell, or hybrid by 2030. This means that if half of all cars sold by 2030 were electric, EVs could make up between 60%-70% of cars on the road by 2050.

Before we get into the details, let's take a quick run through all the acronyms making up the current Elective Vehicle landscape:

- EV (Electric Vehicle): All vehicles that are fully powered by Electricity or an Electric Motor.

- BEV (Battery Electric Vehicle): BEVs, also known as “all-electric” vehicles, use batteries that can be recharged. BEVs sustain their power through the batteries and must be plugged into an external electricity source to recharge. They have varying driving ranges and charge times. Example: Tesla Model S.

- HEV (Hybrid Electric Vehicles): An HEV utilizes a dual electric propulsion system and an internal combustion engine. Example: Toyota Prius.

- ICE (Internal Combustion Engine): An ICE is powered by combustible fuel, often petroleum, diesel, or natural gas products. Example: Toyota Corolla.

- PHEV (Plug-in Hybrid Electric Vehicles): PHEVs are a mixture of all-electric vehicles and internal combustion engines containing a battery that can be charged externally. The big difference between these vehicles and HEVs is that their rechargeable battery can be charged by plugging into a power source. Example: Chevrolet Volt.

Now let's look at some of the key findings and most insightful takeaways from the Mullen study concerning BEV ownership.

Battery Electric Vehicle Ownership

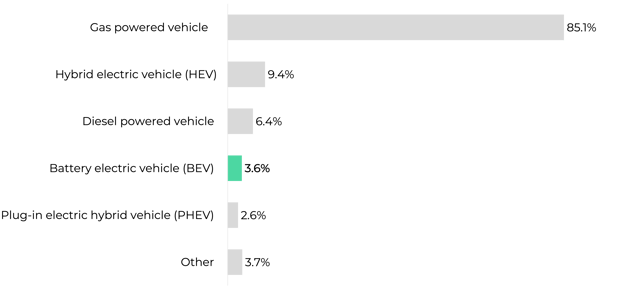

Among broader market, likely socio-economically enabled purchasers (US Adults – HHI $50K+), BEV ownership registered at 3.6%.

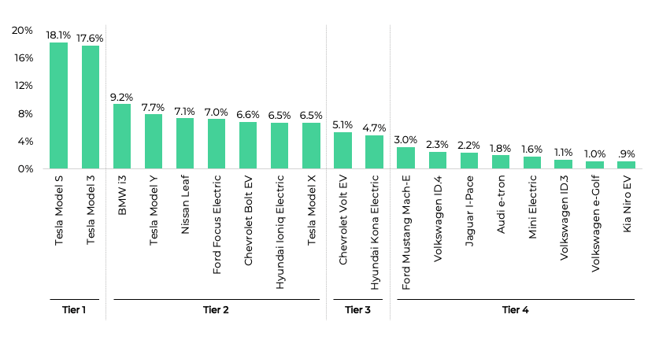

Not surprisingly, in terms of ownership, the Tier 1 category leaders include the legacy sales representing the Tesla Model S (18.1%) and the newer Tesla Model 3 (17.6%).

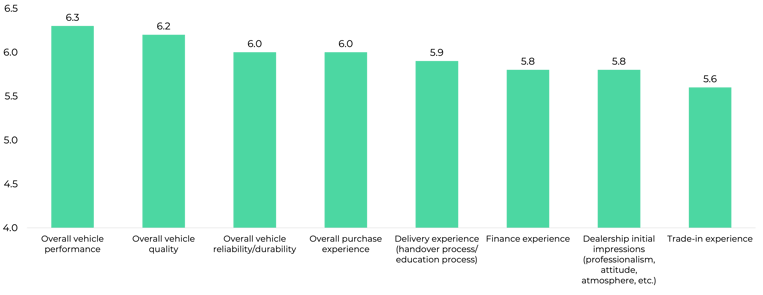

BEV owners were most satisfied with their “Overall vehicle performance,” followed by: “Overall vehicle quality” and “Overall vehicle reliability/durability.”

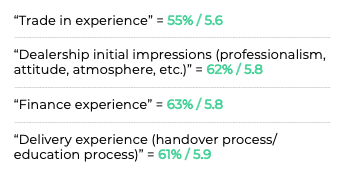

BEV owners indicate the following categories presented the greatest opportunity for improvement.

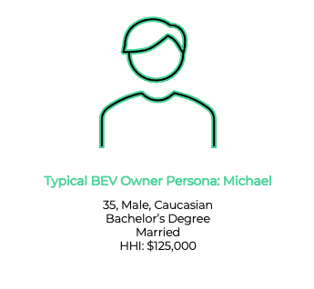

Who Owns Battery Electric Vehicles - Demographics

Gender: Primarily male(67%). Females are significantly more likely to be “Fence Sitters” or “Rejectors”

Age: Primarily under the age of 45 (68%)

Education: Primarily those with higher education (a college degree+) (56%)

Ethnicity: Predominantly White/Caucasian (62%) followed by Asian (15%)

Relationship: Predominantly Married/Cohabiting/Domestic Partnerships (72%)

Annual Household Income: Predominently higher household income segments ($100K+) (62%)

Who Owns Battery Electric Vehicles - Psychographics, Attitudes, and Opinions

BEV Owners tend to have a significantly elevated strength of conviction regarding their personal attitudes and opinions. They are among the most highly motivated to achieve financial security, significantly more satisfied or content with their life in general. They project the highest degree of self-confidence; and as a likely consequence, are significantly more inclined to perceive themselves as a leader. They are also more politically motivated, the least conventional, and place the highest degree of importance upon maximizing fun and enjoyment in their lives.

Stay tuned for Part Two: Part two of this post will examine how BEV prospects differ from current BEV owners regarding demographic, psychographic, and behavioristic characteristics. It will also explore key EV category purchase dynamics and examine desired product attributes and barriers to purchase.