David Michery, CEO and chairman of Mullen Automotive, appeared on ‘Making Money with Charles Payne’ on Fox Business on Thursday, Aug. 31, to discuss lawsuit against large brokerage firms for unlawful trading practices of the Company’s stock and other matters.

BREA, Calif., September 1, 2023– via InvestorWire – Mullen Automotive, Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an emerging electric vehicle (“EV”) manufacturer, announces today its response to a question asked during Mullen CEO David Michery’s appearance on Making Money with Charles Payne, which aired on Fox Business at 2:55 p.m. EST on Aug. 31, 2023.

Michery and Wes Christian of the law firm of Christian Attar were interviewed by host Charles Payne to discuss various matters and, notably, Mullen’s recent lawsuit against large brokerage firms including TD Ameritrade, Charles Schwab, National Finance Services, and others alleging that these broker-dealers engaged in a scheme to manipulate the share price of the Company’s securities. Mullen hired the services of Christian Attar in partnership with Warshaw Burstein, LLP to file this lawsuit and has taken a number of measures to combat illegal short-selling activities to protect retail investors.

“During the broadcast yesterday, the feed provided by Fox lost its audio connection with us, and as a result we did not have a chance to respond at the end of the segment,” said David Michery, CEO and chairman of Mullen Automotive. “Below is our response to Charles’ last question.”

Charles Payne Question:

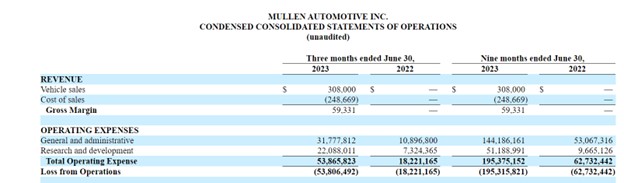

Can you explain $31 million in G&A per the Condensed Consolidated Statements of Operations?

Mullen Response:

The Condensed Consolidated Statements of Operations contains both cash and non-cash expenditures in total operating expenses. For the three months ended June 30, 2023, we incurred $7.8 million of non-cash expenses including:

- $6.6 million of non-cash charge for warrants provided to Qiantu.

- $4.1 million in stock-based compensation to employees and consultants.

- $2.5 million in depreciation and amortization.

- ($5.4) million in increased working capital as we move into production of our commercial vehicles.

Pursuant to the Condensed Consolidated Statements of Cash Flows, we spent $46.1 million ($15.3 million per month) in operating expenses as compared to the $53.9 million of Total Operating Expenses reported on the Condensed Consolidated Statement of Operations:

Three Months Ending June 30, 2023

Operating Activities: $(46.1) million

Investing Activities: $(10.0) million

Financing Activities: $196.8 million

Please refer to our press release related to our quarterly third quarter results, issued Aug. 14, 2023, for further information.

If you compare our operating cash flows to our competitors, you will see that we operate very efficiently. Mullen also has a strong balance sheet with $352 million in stockholders’ equity, $560 million in total assets and total notes payable of only $7.3 million.

For example, Canoo reported a $62.3 million use of operating cash flow for the quarter ended June 30, 2023. Nikola reported $107.2 million use of operating cash flow for the quarter ended June 30, 2023. Workhorse reported $33.1 of operating cash flow for the quarter ended June 30, 2023. As noted above, Mullen used $46.1 million of operating cash flow for the quarter ended June 30, 2023.

Mullen Automotive Inc.

Condensed Consolidated Statements of Operation (unaudited)

About Mullen

Mullen Automotive (NASDAQ: MULN) is a Southern California-based automotive company building the next generation of electric vehicles (“EVs”) that will be manufactured in its two United States-based assembly plants. Mullen’s EV development portfolio includes the Mullen FIVE EV Crossover, Mullen-GO Commercial Urban Delivery EV, Mullen Commercial Class 1-3 EVs and Bollinger Motors, which features both the B1 and B2 electric SUV trucks and Class 4-6 commercial offerings. On Sept. 7, 2022, Bollinger Motors became a majority-owned EV truck company of Mullen Automotive, and on Dec. 1, 2022, Mullen closed on the acquisition of Electric Last Mile Solutions’ (“ELMS”) assets, including all IP and a 650,000-square-foot plant in Mishawaka, Indiana.

To learn more about the Company, visit www.MullenUSA.com.

Forward-Looking Statements

Certain statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1934, as amended. Any statements contained in this press release that are not statements of historical fact may be deemed forward-looking statements. Words such as “continue,” “will,” “may,” “could,” “should,” “expect,” “expected,” “plans,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential” and similar expressions are intended to identify such forward-looking statements. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control of Mullen and are difficult to predict. Examples of such risks and uncertainties include but are not limited to the impact and outcome of the referenced lawsuit. Additional factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements can be found in the most recent annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed by Mullen with the Securities and Exchange Commission. Mullen anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Mullen assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only as of the date they are made and should not be relied upon as representing Mullen’s plans and expectations as of any subsequent date.

Contact:

Mullen Automotive, Inc.

+1 (714) 613-1900

www.MullenUSA.com