Company fiscal Q2 outperforms all previous quarterly revenue results

Mullen achieves strong results with $5M revenue for quarter ending March 31, 2025

Company revenue is $7.9M for six months ended March 31, 2025

Company net loss decreased substantially from $132.4M in fiscal Q2 2024 to approximately $47.1M in comparable quarter ending March 31, 2025

Company cash spend reduced significantly from $120.9M to $52.4M for the six months ended March 31, 2025

BREA, Calif., May 20, 2025 (GLOBE NEWSWIRE) -- via IBN – Mullen Automotive, Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an electric vehicle (“EV”) manufacturer, today announces financial results for the three months ended March 31, 2025, and a current business update.

Commenting on the results for the three months that ended March 31, 2025, and recent Company highlights, CEO and Chairman David Michery stated: “Our Q2 2025 revenue of $5 million outperformed Q2 2024 revenue of $33,000 by more than 143 times. This growth underscores the effectiveness of our strategic initiatives and increasing demand for our vehicles despite challenging market conditions.”

Recent and Fiscal Q2 Highlights

Mullen Commercial – Troy, Michigan

Class 1 and 3 Commercial Vehicles

- Sale and order activity for Mullen commercial EVs in the last quarter include:

- Cashflow on Wheels, a leading logistics company with a focus on transitioning FedEx and Amazon last-mile local delivery to electric vehicles, placed an order and took delivery on 20 Class 3 vehicles. The order includes a retail value of approximately $1.4 million.

- Global Expert Shipping (“Global Expert”) located in Glendale, California, purchased the all-electric Mullen ONE Class 1 cargo van for maintenance and material transport tasks, with additional orders to follow.

- Local government of Orange County, North Carolina, purchased the Mullen ONE, Class 1 EV cargo van. The vehicle will be deployed by Orange County’s Solid Waste Management Department, and the order was fulfilled by National Auto Fleet Group (NAFG).

- Additional Class 1 and Class 3 vehicles delivered to national leading universities in Northern and Southern California.

- Mullen Commercial EVs have been added to National Auto Fleet Group’s (NAFG) Sourcewell contract and are approved for public sector government purchasing through NAFG’s contract 091521-NAF which offers Class 1-3 light duty trucks, cars, vans, SUVs, cab chassis, and electric vehicles with related equipment and accessories to U.S. government agencies.

- Ride-and-drive events, conducted in the last quarter to increase awareness in many commercial fleet verticals, include ACT Expo, NTEA’s Work Truck Week and ZEV Tour – Clean Fleet Experience.

Bollinger Motors – Oak Park, Michigan

Class 4 Commercial Truck

- In May 2025, Bollinger Motors delivered a Bollinger B4 Class 4 electric vehicle to The Lower East Side (“LES”) Ecology Center. The vehicle will be used as both a work truck and delivery truck, supporting various LES Ecology Center environmental initiatives including the longest running compost program in New York City.

- In April 2025, Bollinger Motors delivered the first 2025 Bollinger B4 truck of multiple orders to EnviroCharge for conversion into a mobile charging unit. Initial EnviroCharge Bollinger B4 Truck was upfitted as Mobile Charging Unit for reveal at ACT Expo on April 28, 2025.

- Bollinger announced a strategic partnership with EO Charging (“EO”), a global pioneer in electric vehicle charging solutions for depot-based fleets, which will provide comprehensive electrification solutions for Bollinger Motors’ commercial fleet customers and dealers.

- After the balance sheet date, on May 7, 2025, the U.S. District Court for the Eastern District of Michigan entered an order placing Bollinger Motors, Inc., a majority-owned and material operating segment of Mullen Automotive Inc., into court-appointed receivership. Mullen is exploring various options to challenge and resolve this matter and has engaged litigation counsel.

Battery Technology – Fullerton, California

- Mullen signed a partnership and supply agreement with Enpower Greentech Inc. (EGI), a global leader in advanced lithium-ion battery manufacturing and technology, to build and deliver its SWIFT series SSB.

- The Enpower EGI SWIFT SSB are intended for use in commercial vehicles as well as other industrial applications including aerospace, marine, hobby vehicles, material handling, power tools, medical and drone applications.

- Mullen’s production of EGI SWIFT batteries is slated to begin early 2026. Mullen will integrate the EGI SWIFT battery into its existing SSB program in Fullerton, California.

- The Company showcased two battery packs consisting of a 30 kWh and 80 kWh battery packs at the ACT show in Anaheim, California, in May 2025.

Financial Results for the Three and Six Months Ended March 31, 2025

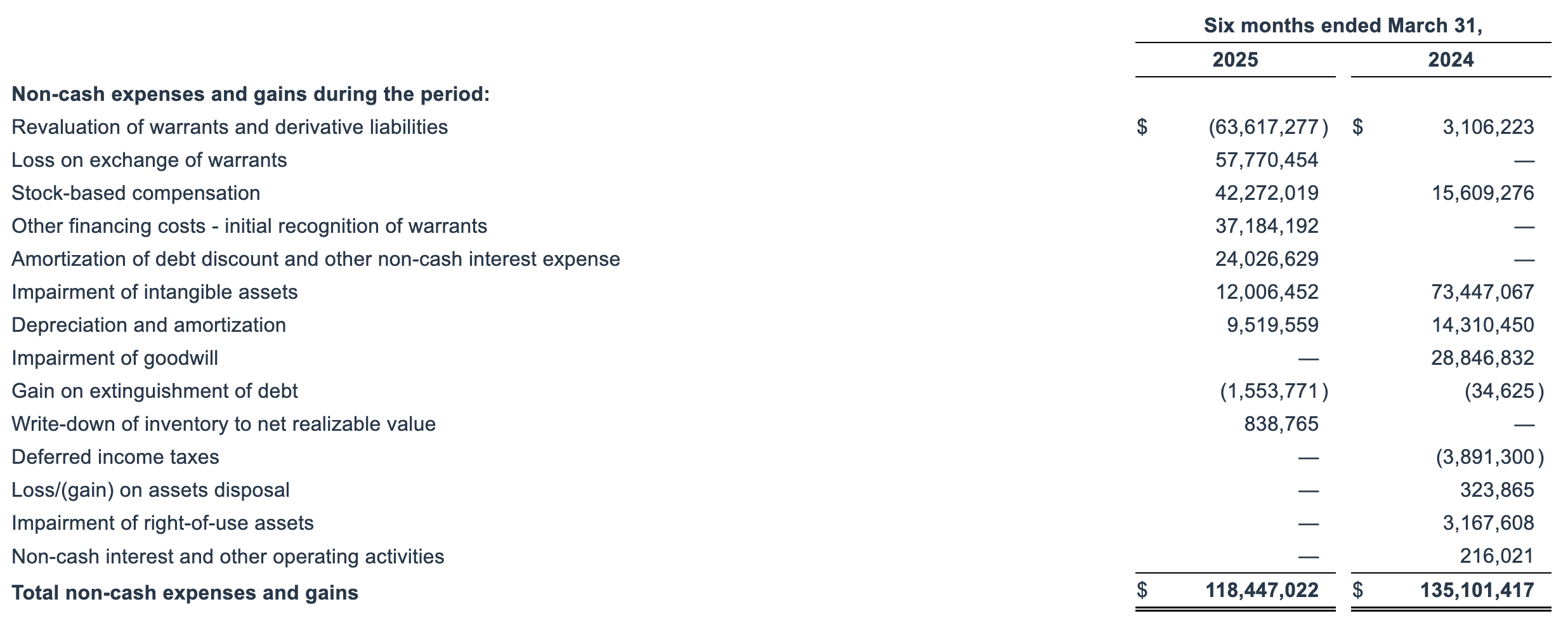

Losses and non-cash expenses

The net loss attributable to common shareholders after preferred dividends was $162.0 million, or $3,338.65 net loss per share, for the six months ended March 31, 2025, as compared to a net loss attributable to common shareholders after preferred dividends of $193.9 million, or $21,493,370.73 loss per share, for the six months ended March 31, 2024 (giving retroactive effect to reverse stock splits).

Major part of the losses during the six months ended March 31, 2025, related to non-cash expenses: $118.5 million or 73% of the loss for the six months ended March 31, 2025, versus $135.1 million (or 70%) for the six months ended March 31, 2024.

Revenue

During the six months ended March 31, 2025, we invoiced for 69 vehicles valued at $5.7 million, received $8.0 million in cash, and recorded $7.9 million in revenues. The Company is deferring revenue recognition on most of Mullen commercial vehicles invoiced until invoices are paid and the return provision on the vehicles is offset when the dealer’s sale of the vehicle to the end user or the dealer chooses to legally forego the return provision.

Liquidity

We had total cash (including restricted cash) of $2.3 million on March 31, 2025, versus $10.7 million on Sept. 30, 2024. The working capital as of March 31, 2025, was negative $156.1 million, or $56.7 million if adding back derivative liabilities and other liabilities expected to be settled in common stock.

The total cash spent on operating and investing activities during the six months ended March 31, 2025 and 2024, was $52.4 million and $120.9 million, respectively, which represents a decrease of $68.5 million, or 56.6%. As it was announced previously, the Company intends to maintain its momentum of reducing the cash outflow by cutting operating costs and restructuring liabilities. Through March 31, 2025, we have financed our operations primarily through the issuance of convertible notes and warrants. Net cash provided by financing activities was $44.0 million for the six months ended March 31, 2025, as compared to $4.9 million net cash spent on financing activities for the six months ended March 31, 2024.

Bollinger Motors – receivership after the balance sheet date

After the balance sheet date, on May 7, 2025, the U.S. District Court for the Eastern District of Michigan entered an order placing Bollinger Motors, Inc., a majority-owned and material operating segment of Mullen Automotive Inc., into court-appointed receivership. Mullen is exploring various options to challenge and resolve this matter and has engaged litigation counsel.

This action followed a legal complaint filed on March 21, 2025, by Robert Bollinger, who alleged a breach of contract related to a $10.0 million secured promissory note executed on October 24, 2024. The court order appointed a receiver with full authority over Bollinger Motors’ operations, governance, and assets, including the ability to operate or sell the business, in whole or in part, for the benefit of creditors.

The promissory note at issue was not guaranteed by Mullen, and no current legal proceedings or court orders impose an obligation on Mullen to fund any shortfall if the assets of Bollinger Motors are insufficient to cover its liabilities. The company does not expect the loss of Bollinger Motors to have a material adverse impact on its liquidity or capital resources.

Financial statements

Following are our unaudited Condensed Consolidated Balance Sheets as of March 31, 2025, and Consolidated Balance Sheets as of Sept. 30, 2024, Condensed Consolidated Statements of Operations and Condensed Consolidated Statements of Cash Flows for the six months ended March 31, 2025 and 2024.

About Mullen

Mullen Automotive (NASDAQ: MULN) is a Southern California-based automotive company building the next generation of commercial electric vehicles (“EVs”) with two United States-based vehicle plants located in Tunica, Mississippi, (120,000 square feet) and Mishawaka, Indiana (650,000 square feet). In August 2023, Mullen began commercial vehicle production in Tunica. In September 2023, Mullen received IRS approval for federal EV tax credits on its commercial vehicles with a Qualified Manufacturer designation that offers eligible customers up to $7,500 per vehicle. As of January 2024, both the Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a Class 3 EV cab chassis truck, are California Air Resource Board (“CARB”) and EPA certified and available for sale in the U.S. Recently, CARB issued HVIP approval on the Mullen THREE, Class 3 EV truck, providing up to a $45,000 cash voucher at time of vehicle purchase. The Company has also recently expanded its commercial dealer network with the addition of Pritchard EV, National Auto Fleet Group, Ziegler Truck Group, Range Truck Group and Eco Auto, providing sales and service coverage in key Midwest, West Coast and Pacific Northwest and New England markets. The Company also recently announced Foreign Trade Zone (“FTZ”) status approval for its Tunica, Mississippi, commercial vehicle manufacturing center. FTZ approval provides a number of benefits, including deferment of duties owed and elimination of duties on exported vehicles.

In September 2022, Bollinger Motors, of Oak Park, Michigan, became a majority-owned EV truck company of Mullen Automotive. Bollinger Motors has passed numerous milestones including its B4, Class 4 electric truck production launch on Sept. 16, 2024, and the development of a world-class dealer and service network with over 50 locations across the United States.

To learn more about the Company, visit www.MullenUSA.com.

Forward-Looking Statements

Certain statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1934, as amended. Any statements contained in this press release that are not statements of historical fact may be deemed forward-looking statements. Words such as "continue," "will," "may," "could," "should," "expect," "expected," "plans," "intend," "anticipate," "believe," "estimate," "predict," "potential" and similar expressions are intended to identify such forward-looking statements. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, many of which are generally outside the control of Mullen and are difficult to predict. Examples of such risks and uncertainties include, but are not limited to, future revenues and earnings of the Company, whether the partnership and supply agreement with Enpower Greentech Inc. (EGI), to build and deliver its SWIFT series SSB will be successful, whether the company will meet the anticipated timeline for production of EGI SWIFT batteries and whether the company will be successful with its initiatives to resolve the Bollinger receivership matter. Additional examples of such risks and uncertainties include but are not limited to: (i) Mullen’s ability (or inability) to obtain additional financing in sufficient amounts or on acceptable terms when needed; (ii) Mullen's ability to maintain existing, and secure additional, contracts with manufacturers, parts and other service providers relating to its business; (iii) Mullen’s ability to successfully expand in existing markets and enter new markets; (iv) Mullen’s ability to successfully manage and integrate any acquisitions of businesses, solutions or technologies; (v) unanticipated operating costs, transaction costs and actual or contingent liabilities; (vi) the ability to attract and retain qualified employees and key personnel; (vii) adverse effects of increased competition on Mullen’s business; (viii) changes in government licensing and regulation that may adversely affect Mullen’s business; (ix) the risk that changes in consumer behavior could adversely affect Mullen’s business; (x) Mullen’s ability to protect its intellectual property; and (xi) local, industry and general business and economic conditions. Additional factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements can be found in the most recent annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed by Mullen with the Securities and Exchange Commission. Mullen anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Mullen assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only as of the date they are made and should not be relied upon as representing Mullen’s plans and expectations as of any subsequent date.

Contact:

Mullen Automotive, Inc.

+1 (714) 613-1900

www.MullenUSA.com

Corporate Communications:

InvestorBrandNetwork (IBN)

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

Editor@InvestorBrandNetwork.com